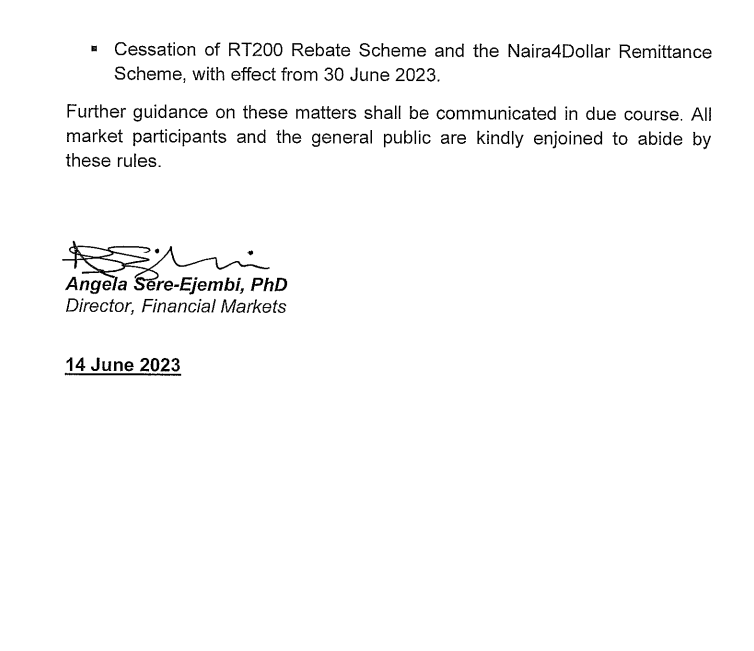

In deference policy thrust of the Tinubu administration, the Central Bank of Nigeria (CBN) has announced “immediate change to operations in the Nigerian foreign exchange (FX) market”.

In a statement signed by the director of financial market, Angela Sere-Ajembi, the bank announced the abolishment of segmentation and collapsed them into a single investors and exporters (I&E) window; reintroduction of the “willing buyer” “willing seller” model at the I&E window among other far-reaching reforms.

All through the Buhari administration, the suspended CBN governor Emefiele adopted a no devaluation stance over the years, a policy which negatively impacted foreign inflows into the local economy. Again, some foreign investors have been unable to upstream funds abroad.

The monetary authority initiated capital control due to the forex shortage. Foreign receipts from oil sales have been under pressure due to a lack of investment in the segment.

In response, the Investors’ and Exporters’ foreign exchange window exchange rate rose sharply to N755 per dollar at N12:50 pm from N471.67 yesterday night. The exchange rate tumbled after the rate cap of the Investors and Exporters (FX) window was removed by the apex bank.

See the details of the new CBN policy below.